how to file back taxes without records canada

Form 4852 Substitute for Form W-2 Wage and Tax Statement is still an option if you dont have a copy of your W-2 or 1099. How to file tax returns for previous years.

Withholding Tax To Non Residents Who Provide Services

A self-employed person after.

. Most Canadians need to file tax returns every year. We Can Help Suspend Collections Liens Levies Wage Garnishments. Use an EFILE certified tax calculation software package.

For the 2021 tax year prior to filing your tax return electronically with NETFILE you will be asked to enter an Access code after your name date of birth and social insurance number. This program is designed as a second chance to correct prior year returns or to file returns that have not been filed. Determine whether you need to contact a tax preparer or you can handle the back taxes on.

If you have any credits to claim such as tuition medical andor donations you. This an affordable option to hiring a tax accountant. The best advice you can follow if youre self-employed is to keep track of everything including income and expenses throughout the year.

Dont Know How To Start Filing Your Taxes. However many Canadians fall behind filing tax returns for a variety of reasons. Tax accounting software is popular in small businesses and appears to be sufficient for personal income tax filing.

17 hours agoIt Is Possible For You To File Your Tax Returns Even If You Were Paid Only In Cash For Your Taxes If You Were Only Paid In Cash For The Year. The rule for retaining tax returns and documents supporting the return is six years from the end of the tax year to which they apply. Next you can manually complete the.

Apr 1 How to File Back Taxes in Canada. Business Tax Personal Tax. Filing Taxes Late in Canada.

File Taxes by Mail. One option is the CRAs Voluntary Disclosure Program VDP. Contact Us by Email or call 1 855 TAX DOCS 1-855-829-3627 for a free no obligation consultation regarding all your back tax filing needs.

If you havent filed tax returns for previous years and you know youll have taxes to pay you may have another alternative. The only reason that it is easy or possible for beginners like you and me to file our taxes online in Canada is because of. Free and cheap tax software in Canada.

Ad Get Back Taxes Help in 3 Steps. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. To file back taxes start by determining which years you need to file and locating the W-2s 1099s or 1098s associated with those years.

Access the EFILE web service to transmit your clients returns directly from your tax preparation software. We Can Help Suspend Collections Liens Levies Wage Garnishments. Dont think that they will.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Ad Get Back Taxes Help in 3 Steps. The tax withholding form asks about your payment.

Connect With An Expert For Unlimited Advice. Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. Steps to Filing Previous Years Tax Returns in Canada Do your Research.

For example a 2015 return and its supporting. Filing taxes if youre self-employed. The experienced Chartered Professional.

Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. If you opt to submit your taxes through the mail instead of online you will need the tax centre mailing address to send in your income tax and benefit. Dont Know How To Start Filing Your Taxes.

The best way to repay back taxes is to simply complete. Connect With An Expert For Unlimited Advice. Ad Receive you refund via direct deposit.

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Tax Checklist For Canadians Tax Checklist Business Tax Financial Checklist

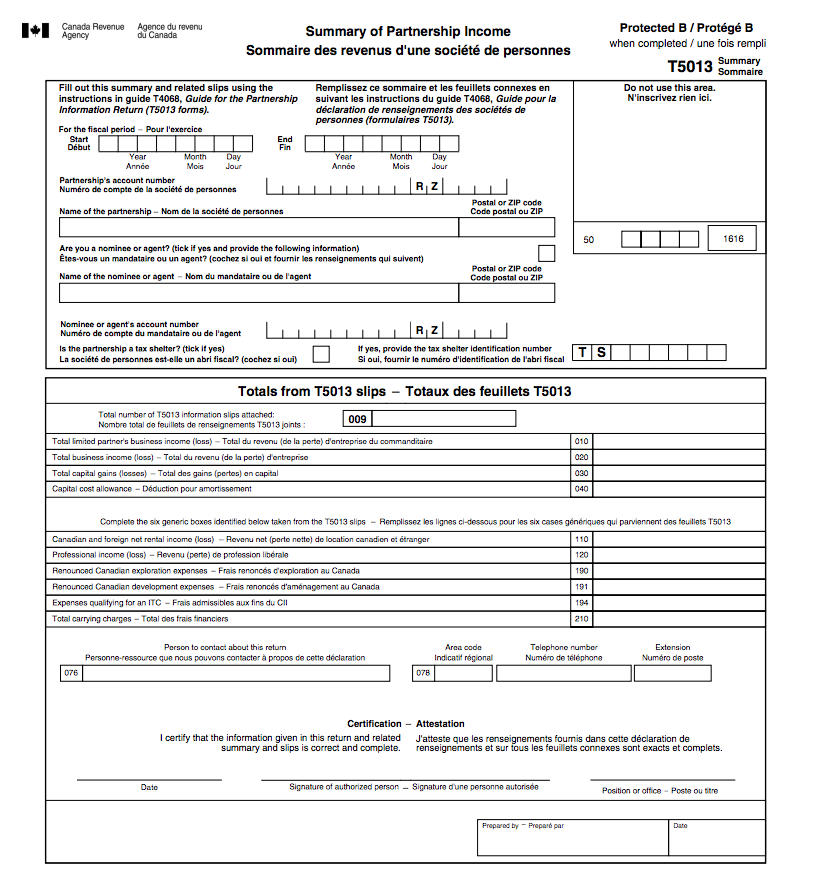

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

The Ultimate Canada Crypto Tax Guide 2022 Koinly

How To File A Late Tax Return In Canada

10 Canadian Tax Credits Deductions You May Not Know Refresh Financial

20 Common Mistakes By Payroll Companies Infographic Internet Marketing Infographics Infographic Marketing Business Marketing Plan

When Is Too Late To File A Canadian Tax Return

How To Download Tax Notice Of Assessment From Canada Revenue Agency Cra Pdf Document Youtube

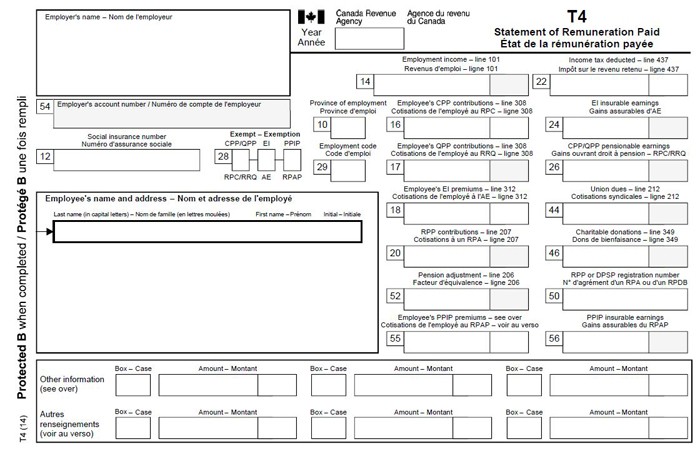

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide